Para Español, selecsione el lenguage, prescione aqui!

Para Español, selecsione el lenguage, prescione aqui!

Se Habla Español!

Frequently Asked Questions

What is Estate Planning?

Estate planning is a legal plan made up of several documents that give authority to your wishes over the property you own at the time of your death or incapacitation.

Do I need a living trust?

A living trust has numerous advantages for managing assets and estate planning. It helps bypass probate, saving time and money. Unlike a will, it maintains privacy. It also allows for asset management in case of incapacity. With a living trust, you have the flexibility to specify how your assets are distributed, including providing for special needs individuals. While it doesn't directly offer tax benefits, it can be structured to minimize estate taxes. It's worth considering!

What is a Living Trust?

A living trust can be described as a legal contract between yourself and your assets where one individual or a married couple, known as the trustee(s), maintains legal title to property on behalf of themselves as beneficiaries while they are alive. You have complete control over all assets kept in trust when you serve as your own living trust's trustee.

What benefits does having a Living Trust bring?

Various living trust arrangements can assist you in avoiding probate, distributing your assets to your preferred beneficiaries, protection from creditors, managing the affairs of your children, managing your affairs if you become incapacitated, tax savings for large estate, flexibility with spouses or establishing long-term property management.

Why should I make a living trust?

Making a living trust is mostly done for peace of mind since it prevents property left in the trust from going through the probate process. In other words, probate is the legally regulated process of allocating your assets to your heirs and paying your obligations. Before the inheritors receive anything, the normal probate case can last for months. By then, there will be less available for them to obtain.

How does a living trust avoid probate?

Before your death, you can fund property into a living trust to avoid probate. The successor trustee, who you designate to manage the trust after your passing, just transfers ownership to the trust's beneficiaries. There are frequently no attorney or court expenses to pay, and the entire process only lasts a few weeks.. Most people who are thinking about using a living trust want to avoid paying a sizable portion of their estate to probate attorneys and instead want to leave as much of their money as possible to their children or other family members. Living trusts can assist in avoiding probate and the associated costs in this situation. A simple living trust enables the rapid and easy transfer of property to the beneficiaries you designate without the hassles and costs of probate court procedures. It ensures the belongings you leave behind will be received by the intended beneficiaries within a reasonable time since probate can take 12 – 18 months. One simple living trust can be used by a married couple to manage both their joint and separate property.

Is it expensive to create a living trust?

A basic living trust is not much more complicated than a will. Our services can be completed for as little as a ONE TIME INVESTMENT. We all worry about making monthly insurance payments for our homes, vehicles, and other types of items to safeguard the interest of our investments, but we frequently overlook the most crucial objective, which is to ensure that our legacy continues on through our wishes.

Is a living trust document ever made public, like a will?

No. A will becomes a public record when it is filed with a probate court, like all other documents involved in probate, such as an inventory ofthe decedent's assets and liabilities. However, the terms of a living trust need not be made public.

Why do I need to transfer assets to my Trust?

Your trust documents demonstrate the legal formation of the trust and are used to verify thatthe trust exists. Funding your Trust, or transferring assets to your Trust, is the process of legally renaming your assets from your name to thename of the Trust. By transferring ownership of your assets from your name to your trust's name, it is legally guaranteed that those assetsavoid probate and are distributed according to the terms described in your trust document. Since you are the principal trustee in your trust forlife, you have full control over all assets transferred into your trust until your death.

Can I transfer my house to the Trust if I have a mortgage?

Of Course! Just notify your mortgage company or lender as additionaldocumentation may be required. You should also check that your mortgage includes a maturity date and get written confirmation that thetransfer will not violate any terms of the mortgage or trust deed.

Can I name my vehicle in the Trust?

Yes, by naming a beneficiary in a living trust. The registered owner of a vehicle/vessel may designate a transfer on death (TOD) beneficiary to whom ownership of the vehicle/vessel may be transferred upon death of the owner. The TOD beneficiary is not a registered owner and the signature or consent of the beneficiary is not required for any transaction involving the vehicle/vessel during the lifetime of the registered owner.https://www.dmv.ca.gov/portal/handbook/vehicle-industry-registration-procedures-manual-2/transfers/transfer-on-death-tod-beneficiary/

What types of assets do not need to be re-titled in the living trust?

Certain types of assets are typically not titled in the trust, but often named in the trust as the pay-on-death beneficiary of the trust. These assets include life insurance, retirement accounts, bank accounts such as savings, certificate of deposit, stocks and bonds, brokerage accounts and pay-on-death beneficiary accounts.

Where can I notarize my documents?

We at Nationwide Trusts, Wills, and More are aware of how challenging it may be to find a notary public when you need one, and because we do not include this service as a part of your Living Trust and Will plan, we have put together a list of resources to assist you.

Walk-In

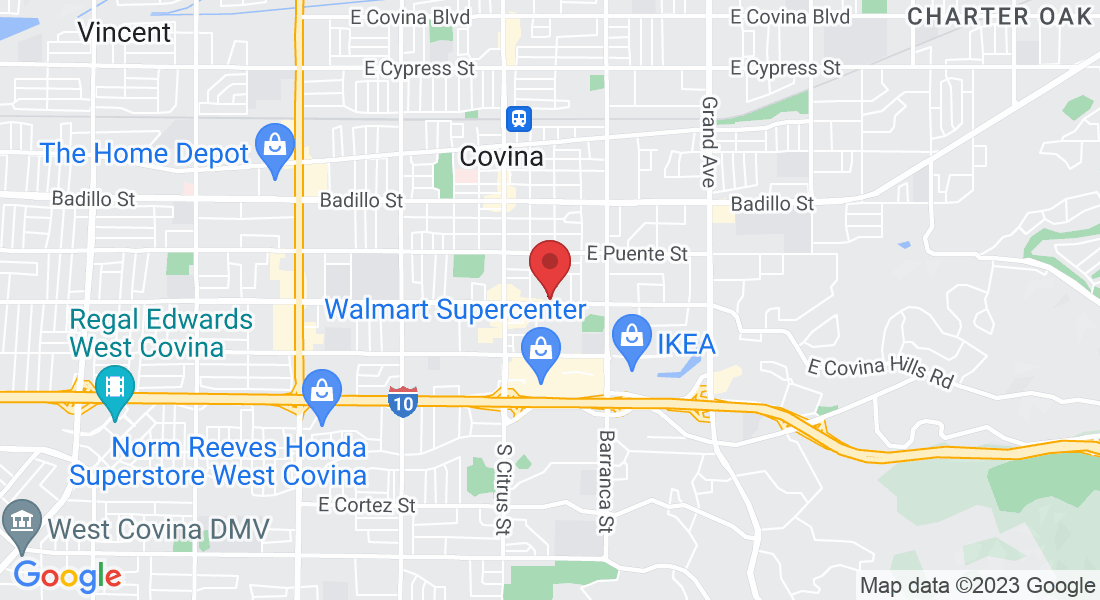

Essence Notary Public is a partner company that is local to all of Los Angeles County and surrounding areas, which offers Walk-Inappointments at Nationwide Trusts, Wills and More headquarters office located at 261 E. Rowland Street, Covina, CA 91723.

For Mobile Notary services through Essence Notary Public, our Notaries are available to come to your chosen location all through California, at your desired time, and most importantly at your convenience. To schedule your appointment, call (661)675-5177 or select the best date and time that works for you:

https://calendly.com/d/4t7-vd6-bgw/30min

Cost to Notarize

In California the Notary fee per signature is $15. For a Will or a Trust package your looking at somewhere between $100-$250 (depending of what type of documents need to be notarized.) This does not include the Mobile Notary travel fee.

Most local notaries in your area can notarize your documents, make sure you call to verify if they offer this service for your specific type of documents.

Local Banks and Credit Unions may offer notary services to their clients.

Search local notary on Google search, Yelp, Yellowpages, UPS Store Finder

Essence Notary Public is a third party partner, therefore Nationwide Trusts, Wills and More does not assume liability for services provided by Essence Notary Publi

What is a Certification of Trust?

The trust certificate is a short document that summarizes the key terms of the trust without revealing thetrust's private details. Trust certificates are used when dealing with others about a trust with which you may need to share some informationbut may not want to share an entire copy of the trust. The certificate of trust sets out the basic details of the trust, identifies the trustees, and summarizes the powers held by the trustees. The trustcertificate does not identify assets held in the trust, beneficiaries, or gifts made under the trust. A trust certificate may also be called a trustcertificate, trust summary, or trust certificate.

Why do I need a Power of Attorney?

A power of attorney allows you to appoint an agent to act and make decisions on your behalf. This is extremely important if you are unable to act on your own for medical or other reasons. For example, if you become incapacitated, the Agentmay be authorized to make decisions about your medical treatment, continue to operate your business, and pay your personal bills. Without apower of attorney, a lengthy and costly legal process may be required to authorize these essential actions. A power of attorney is an importantpart of a basic estate plan that everyone should have on hand. Accidents and illnesses are unpredictable and can wreak havoc on you and yourfamily. Having power of attorney on hand can make it a little easier for you and your family to get through a difficult situation.

What does the structure of a living trust look like?

The owner of the property also known as the Settlor/Grantor creates a living trust that is titled in the trust.

The property is then managed by a trustee, which is usually the owner of the property, however can be someone designated of your choosing.

The trust is then managed and distributed by the trustee for the benefit of a beneficiary.

Upon the Settlor/grantor’s incapacity or death, a Successor Trustee then manages the property either for the owner if the owner is alive but incapacitated, or for the owner’s beneficiaries.

What type of assets can I transfer to a living trust?

In order to fully have a properly functioning trust, it must be funded. Funding of a trust means that the re-titling of the property must be done, in real estate, the deeds must be renamed under the living trust. Some of the types of assets to be re-titled in a living trust are:

Real estate property

Asset accounts such as bank accounts, stock accounts, portfolio accounts etc.

Business interest such as shares in a privately held company, LLC memberships.

Intellectual property such as Copyrights: pictures, audio and video recordings, maps, publications, web page content. Patents: inventions, processes. Trade Secrets: methods, techniques, processes.

What happens after a revocable living trust is created?

Be sure to do the required paperwork to transfer property to or from the trust. For example: Kimberly and Albert McAdams put their home in a living trust to avoid probate, and later decided to sell. In a real estate contract and deed transferring ownership to the new owners, Kimberly and Albert would sign their names “as trustees of The McAdams Revocable Living Trust.” No separate income tax records or returns are necessary as long as you are both the grantor and the trustee. (IRS Reg. § 1.671-4.) Income from property in the living trust must be reported on your personal income tax return; you don't have to file a separate tax return for the trust.

How does the living trust work after your death?

With most Living Trusts, someone else, like a trusted friend, relative, or a professional trustee, will take over as trustee when you die or become incompetent.

At that point, the trustee has certain legal duties, including:

manage and invest your property

spend trust assets for your benefit (if still living), and

when you die, pay all of your debts and distribute or manage all trust assets according to your instructions.

Sometimes the terms of the trust will direct the trustee to NOT distribute the assets right away. The beneficiaries may be children or considered too young to handle their inheritance. Alternatively, the assets may continue in trust after the settlor dies for tax purposes or to protect the ultimate beneficiaries from creditors.

The successor trustee does not need to ask the court to get involved. S/he will probably only need the trust document and a death certificate.Probate and Inheritance:

What is a decedent’s estate?

Decedent’s estate" is a formal way of referring to the property left behind after a person's death. A "decedent" is a person who has died, and their "legacy" is the property they owned at the time of death. In California, a decedent's estate can be divided in three ways: as a "small estate" of less than $150,000; in probate court as an independent probate procedure (when the deceased left a will appointing an executor); or in probate court as an estate supervised by the court (when the deceased did not leave a will or appoint an executor).

Does every estate have to go through court?

If there are few assets in the estate, or if the person plans their estate to avoid probate with a trust or other probate avoidance tactics, the court may not be needed.

What is the procedure if there is a will?

If the deceased leaves a will, they usually appoint someone to act as the personal representative of the estate, known as an "executor". Unless the will prohibits procedures authorized by the California Independent Asset Management Act (which rarely happens), the executor is responsible for the preparation of an inventory and bookkeeping; division of heritage property; and pay real estate taxes and debts. This is known as the “independent probate process” because the executor has full authority over the estate and can make decisions without court supervision.

What if the decedent left no will or the will did not name an executor?

If there is no will, the probate court will appoint an administrator. If there is a will but no executor is named, the court will appoint a “manager of the attached will”. Like the executor of a will, the administrator is responsible for meeting all the necessary conditions for the division of the estate's assets, with one important distinction: the trustee has only limited power to manage the decedent's estate and must obtain court approval before taking certain actions. This type of proceeding is known as a "court-supervised estate".

What if the decedent had a trust?

When the trustee (or, in the case of a spousal joint trust, the second trustee) dies, the successor trustee takes over and divides the assets according to the terms of the trust document. . The trust document itself must name the successor trustee. To establish jurisdiction over the estate of the deceased, the successor trustee provides businesses and organizations with death certificates, affidavits, and/or trust documents.

Real estate transfers without probate

Special non-judicial proceedings apply if the property is in trust, held by more than one person (common or community owner) or secured by a deed of assignment in the event of death (the beneficiary) benefit).

Small estates (under $150,000, no real estate)

If the deceased person does not own real estate (or if the estate is transferred outside of probate), assets such as bank accounts, insurance, custodial property, etc. can be recovered by an heir using a notarized small estate affidavit (also called an affidavit of personal collection) without going to court.

Can a Living Trust help save or reduce estate taxes?

Yes. There are several kinds of Living Trusts that let you avoid, reduce or postpone federal estate taxes. Contact Denise Torres, Attorney at law about your choices.

What is Joint Tenancy?

Property owned in a joint tenancy automatically passes to the surviving owner when one owner dies. In California, each owner in a joint tenant owns an equal share in the property.

What is Community Property with Right of Survivorship?

California is a community property state, which generally means that any and all property acquired during the marriage is considered jointly unless there have been steps taken to keep it separated. If the spouses or partners hold title of an asset as community property with right of survivorship, then it automatically passes to the survivor spouse or partner upon the death of the spouse/partner.

How to Fund Your Living Trust?

Once you have notarized your living trust documents, you are not completed until you finish one more crucial step. Funding the trust is the biggest component in controlling the distribution of your property and assets. To further assist, Nationwide Trusts, Wills and More has partnered with uDEED Company which specializes in the document preparation of various deed preparations and county recording filings.

You can call uDEED at 866-486-5500, visit their website at www.udeed.com

or follow this link to schedule a time to speak with a deed specialist: https://calendly.com/deedteam/30min?month=2023-09

uDEED is a third party partner, therefore Nationwide Trusts, Wills and More does not assume liability for services provided by uDEED.

Our Client's Opinion Matters

safeguard your family and assets today

Don't wait for uncertainties to arise – take charge of your future now. Our proactive approach empowers you to shield your assets and ensure your family's well-being. By acting today, you create a resilient foundation that safeguards your legacy and provides peace of mind for whatever tomorrow may bring

Have A Question?

Our assistants are available to answer questions you might have regarding the service and process we take to create your last will and testament and/or trust. Fill out the form below with your question, and our knowledgeable team will be swift in providing you with the guidance you need. Your concerns are important to us, and we're dedicated to ensuring that you receive the information necessary to make informed decisions for your future. Let us be your trusted resource on your estate planning journey.

Navigation

Nationwide Trusts, Wills and More is not a law firm, State or Government agency, and cannot represent you. Our Legal Document Assistants and Staff members are not attorneys and cannot give you legal advice. We work solely under your direction. We are not a one size fits all program and should not be used as a replacement for an attorney. We recommend you speak with an attorney for complex or exceptionally large Estates. The information you obtain on this site is not, nor is it intended to be, legal advice. You should consult an attorney for advice regarding your individual situation. We invite you to contact us and welcome your calls, letters, and electronic mail.